Net Debt: EUR 1 125m

(Net debt as of September 30, 2025)

Rating

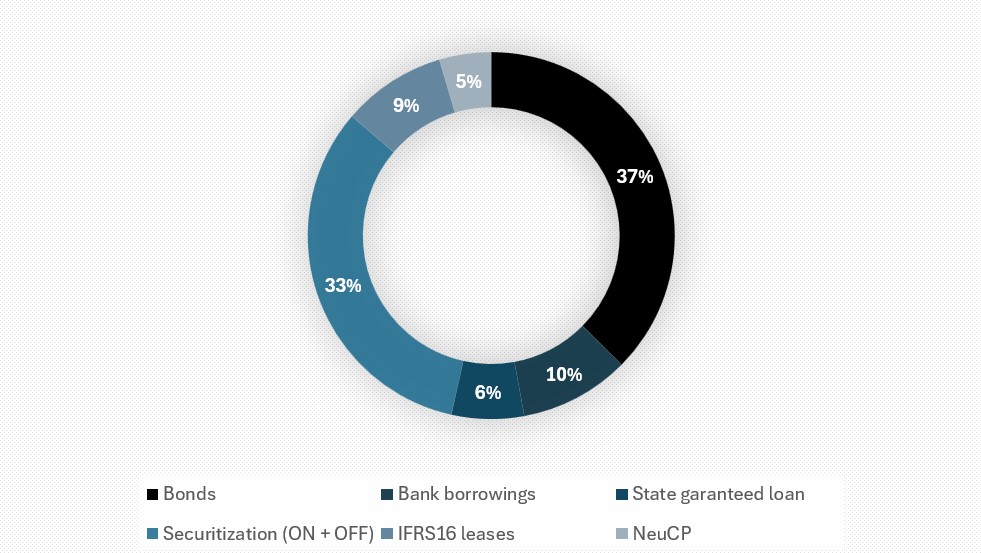

Debt structure

(as of September 30, 2025)

Structure of funding sources

Including IFRS16 and On/Off securitization

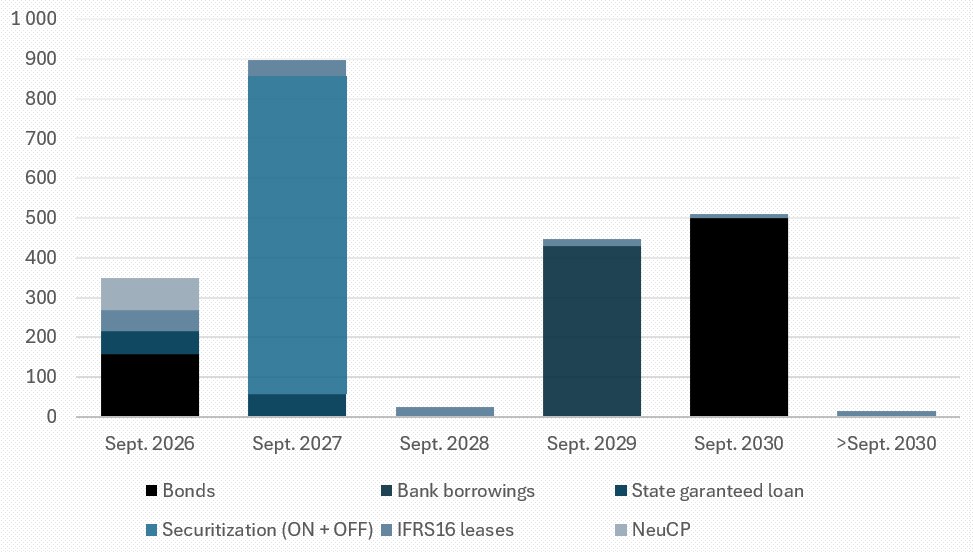

Debt by maturity

Including IFRS16 and On/Off securitization

(in million EUR)

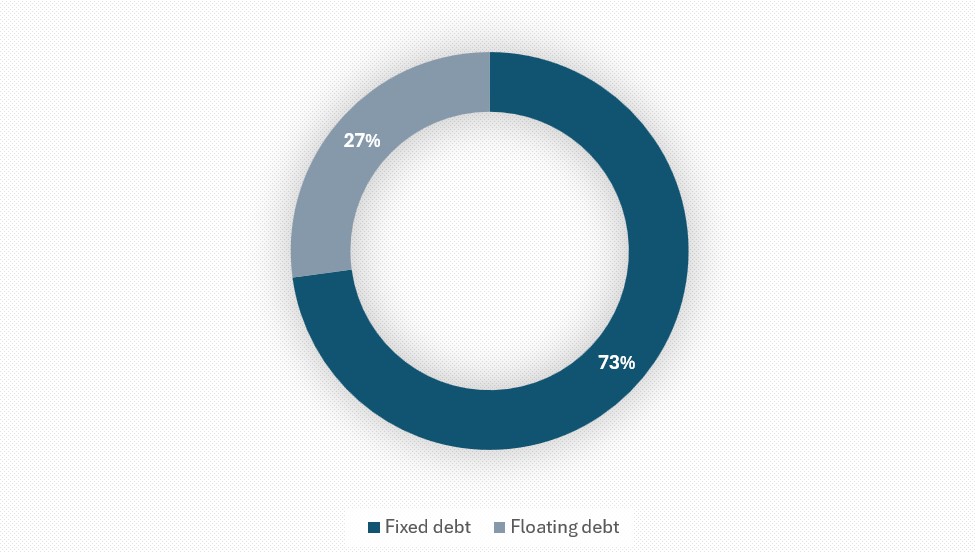

Debt structure by interest rate

Gross debt after interest rate hedging, including On/Off securitization and excluding IFRS16

Financial covenant

Debt Covenant - Net Debt / EBITDA (including IFRS 16) = 4.5x

(September 30, 2024 onwards)

Net Debt/EBITDA = 3.3x

(as of September 30, 2025)

Bonds

| ISIN | Bond issue | Maturity | Nominal amount (in million EUR) | Coupon |

|---|---|---|---|---|

| XS2360381730 | July 8, 2021 | July 15, 2026 | 159 | 3.75% |

| XS2980875376 | February 04, 2025 | March 15, 2030 | 500 | 5.625% |